Mountain Dew, with its vibrant branding and energetic marketing, stands out in the beverage industry, especially with its caffeine content. Understanding its caffeine levels becomes crucial for business owners looking to cater to consumer demands, drive sales, and understand competitor offerings. With various flavors and product lines, such as Original and Mountain Dew Zero Sugar, each maintains a caffeine level of approximately 55 milligrams per 12-ounce can, providing insight into potential energy boosts for consumers. This article explores Mountain Dew’s caffeine levels in depth, comparing them with other soft drinks, discussing their significance for health and energy, recognizing consumer preferences, and tracing the evolution of these levels over time. Each chapter offers valuable insights for business owners aiming to position their offerings effectively in a competitive landscape.

Raising the Peak: Decoding the Caffeine Buzz Behind the Brand’s Signature Citrus Soda

Caffeine is a quiet driver in the world of everyday drinks, a substance that can sharpen focus, quicken reaction times, and sometimes loosen the lid on late-afternoon drowsiness. In the realm of popular, mass-market soft drinks, the citrus-flavored staple known for its brisk kick has earned a reputation for delivering a noticeable energy lift. The way this beverage communicates its buzz is grounded in the standard serving size many consumers reach for—an ounce-for-ounce snapshot of caffeine that has become a benchmark for comparison across the shelf. When you crack open a 12-ounce can of this flagship citrus beverage, the caffeine you ingest is around 55 milligrams. That figure, widely reported and repeated, places the drink among the higher-caffeine options within mainstream sodas. It’s enough to be felt: not a wall of alertness, but a clear nudge that can sharpen attention for tasks that require a quick tempo or a steady, sustained push of energy during a long day. For gamers, athletes, students, or anyone looking for a brisk lift without reaching for an extra cup of coffee, that 55-milligram jolt often fits neatly into a daily rhythm—provided, of course, it’s consumed with awareness of total caffeine exposure across all sources.

Yet caffeine content is not a fixed footprint across every variation of this brand’s lineup. The original formula maintains the around-55-mg-per-12-ounce baseline, but the company also markets enhanced formulations designed for maximal energy. In those cases, reports and labeling indicate a higher caffeine load, with some versions approaching or surpassing the 70 mg per 12-ounce mark. Those higher-caffeine releases are targeted at consumers who want the strongest possible kick from a familiar format. They are not hollow promises; they come with a trade-off. The same chemical that sharpens alertness can also contribute to jitters, a quicker heartbeat, or sleep disruption if the beverage is consumed too late in the day. The choice becomes a balance between the desire for a rapid, dependable lift and personal sensitivity to stimulants. In broader terms, this is a reminder that “high caffeine” is a spectrum rather than a single number, and the wording on the can or bottle matters as much as the number itself.

To place these numbers in a broader context, it helps to compare them with other carbonated options that share the same market shelf. On average, many similar beverages sit in the 30-40 mg range per 12-ounce serving, with some even lower. The 55 mg figure for the standard serving of the citrus soda in question stands out in that landscape as a relatively robust caffeine payload. It’s not the extreme edge of caffeinated beverages, but it is substantial enough to set a pace in a lineup where the pace matters. That distinction—between a solid everyday lift and the highest-energy formulations—frames a practical question for readers: how does caffeine in this drink fit into a daily plan that already includes coffee, tea, or other caffeinated sources? The answer hinges on personal tolerance and the total intake from all beverages, but the baseline remains an influence many people feel without deliberate effort to measure it.

For readers navigating this landscape, the conversation often turns to the sugar and calorie side of things. The brand offers sugar-containing variants as well as zero-sugar options that preserve a familiar caffeine profile. In other words, you can opt for a version that gives you the same peppy caffeine jolt while aligning with lower sugar or zero-calorie goals. The caffeine content tends to track similarly across these options, which means the decision to cut sugar does not automatically reduce the stimulant load. That coupling—high caffeine with either regular sugar or zero calories—makes it important to read labels carefully and to consider how different choices fit into a day that already includes other caffeine sources.

From a health-and-safety perspective, the caffeine ceiling recommended by health authorities provides a useful guardrail. The U.S. Food and Drug Administration suggests that healthy adults can safely consume up to about 400 milligrams of caffeine per day. In practical terms, a couple of these 12-ounce servings could bring a person close to that limit, particularly if other caffeinated products are part of the daily mix. The risk isn’t just about the single can; it’s about the cumulative load. Individuals who are more sensitive to caffeine, pregnant, or managing conditions that caffeine can aggravate—such as anxiety disorders, arrhythmias, or insomnia—should consider this broader picture before drinking multiple servings in a day. This is where real-world moderation becomes more meaningful than any one-off speculation about a single can’s effect. Understanding serving size, knowing how many milligrams lurk in a given can, and accounting for other sources of caffeine are practices that empower readers to enjoy the beverage without unintended consequences.

The way caffeine works in the body also matters for the everyday consumer. Absorption happens quickly, and the stimulant effect tends to peak within an hour or two in most people. The duration can vary; some individuals feel the lift for several hours, while others may notice the effects fade more rapidly. Genetics, weight, tolerance built up through repeated exposure, and concurrent use of medications all shape the experience. These nuances are worth noting because they influence not only when you reach for a can but also when you choose to avoid it—especially if sleep is a priority or if late-afternoon caffeine tends to keep you awake. In that sense, caffeine content is not merely a number; it’s a factor that interacts with daily schedules, exercise plans, work tasks, and social routines. A thoughtful approach to consumption treats the number on the label as a guide rather than a command.

From a consumer education standpoint, this chapter emphasizes three takeaways. First, the standard 12-ounce serving of the flagship citrus beverage delivers about 55 mg of caffeine, a figure that places it above many competitors in the broad market of sodas. Second, there are higher-caffeine variants marketed for a stronger energy boost, with some versions bringing the total closer to 70 mg per can. Third, while sugar-free and zero-calorie variants offer similar caffeine levels, these choices do not automatically reduce stimulant intake. Reading the label remains essential for anyone trying to manage caffeine responsibly. These points together help readers calibrate their consumption in a way that aligns with daily routines, health goals, and personal sensitivity.

To deepen this understanding, consider exploring a dedicated breakdown of caffeine content for this citrus-forward beverage. The article on caffeine content for this soda provides a clear, itemized view of how much caffeine is in each serving across the lineup and how those numbers compare to other common drinks. It serves as a practical companion piece to this chapter, offering a data-driven frame for readers who want to quantify their intake with confidence. For a direct read, you can explore a focused analysis at caffeine content MT DEW.

In sum, the caffeine story behind this brand’s signature citrus soda is a case study in how a single product line can carry a nuanced profile. It blends a reliable baseline with the possibility of stronger formulations, all within a framework of standard serving sizes and clear labeling. It invites readers to engage with their own caffeine habits—tracking, balancing, and adjusting as needed to maintain energy without compromising rest or well-being. As you move through the broader arc of this article, keep in mind how small variations in caffeine content can ripple through daily energy, mood, and focus. The next chapter will build on this foundation by connecting caffeine awareness to practical choices, from meal timing to social routines, and will highlight how a simple can’s numbers can integrate into a larger picture of personal energy management.

External reference: for a broader view on official caffeine guidelines and more background on how caffeine is labeled and regulated, see the manufacturer’s caffeine information resource and the FDA guidelines cited in health literature. These sources provide downstream context that helps anchor the numbers discussed here in real-world policy and consumer practice. For primary data on the beverage’s caffeine content from the brand’s own site, see the official caffeine information page.

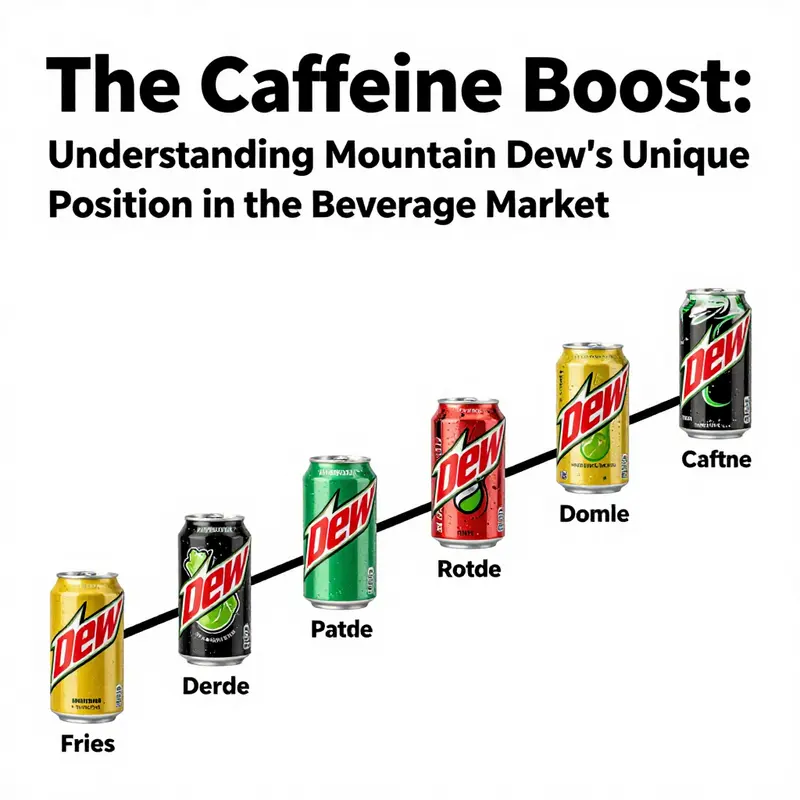

Voltage in a Can: Tracing Mountain Dew’s Caffeine Footprint Within the Soda Spectrum

Caffeine sits at the core of Mountain Dew’s public persona, a bold claim in a crowded aisle where sweetness often competes with quick jolts of energy. In practical terms, a standard 12-ounce can of Mountain Dew is widely cited as delivering about 54 to 55 milligrams of caffeine. That small numeric range hides a larger picture: Mountain Dew stands as a high-caffeine option among mainstream soft drinks, a choice that appeals to anyone who wants a quick lift without crossing into the realm of dedicated energy drinks. This level is not a rumor of rumor; it shows up consistently across the brand’s core offerings, from the Original flavor to favorites like Code Red and Live Wire, and it persists in Mountain Dew Zero Sugar as well. The caffeine signal remains strong, even when calories and sugars are dialed back. The body of data supporting these figures comes from product analyses and official nutritional disclosures, and it aligns with the broader understanding that Mountain Dew occupies a higher perch on the caffeine ladder than many other sodas.

When people talk about Mountain Dew in the context of caffeine, they’re often contrasting it with classic colas and other widely consumed beverages. In the broader landscape, Dr Pepper tends to hover around 41 milligrams per 12-ounce serving, Coca-Cola Classic comes in around 34 milligrams, and Pepsi sits near 38 milligrams. Those figures, while still notable, illustrate a clear hierarchy: Mountain Dew is a benchmark for high-caffeine soda consumption in the mainstream market. For consumers who view caffeine as a tool for focus or alertness—whether gaming, studying, or sustaining physical effort—Mountain Dew’s relative intensity can be a meaningful differentiator. The appeal is not merely about taste or brand identity; it is about a reliable, predictable jolt that people can reach for when they need straightforward stimulation without reaching for an energy drink with a more complex formula.

A closer look at the variants reveals a consistent caffeine profile that reinforces Mountain Dew’s brand identity as a high-energy beverage. Code Red, Live Wire, and Mountain Dew Zero Sugar all deliver roughly 54 milligrams of caffeine per 12-ounce serving. That consistency matters for consumers who rotate between flavors or who choose Zero Sugar to manage sugar intake while preserving the familiar caffeine kick. For someone who habitually consumes a can in the morning or during a late-night gaming session, the message is clear: the caffeine content is not a moving target across flavors or formulations. It’s a deliberate design choice, one that accentuates energy delivery in addition to the drink’s characteristic tang and sweetness. This alignment across variants suggests a strategic balance between flavor engineering and stimulant performance, a combination that resonates with a particular subset of beverage enthusiasts who value timing and intensity as much as taste.

From a consumer perspective, that high caffeine baseline invites a straightforward line of inquiry: how does this drink fit into a daily caffeine plan? Morning routines often blend coffee with sodas or other caffeinated beverages, and the cumulative effect matters. When Mountain Dew and a cup of coffee sit side by side, the total caffeine intake can add up quickly, especially for individuals who blend multiple caffeinated products into one day. The practical takeaway is not a prohibition but a call for mindful consumption. Knowing that a 12-ounce can contributes roughly 54 milligrams of caffeine helps people map their total daily intake, arming them to make informed choices about when and how much to drink. It also raises the question of how Mountain Dew’s caffeine content compares to other beverages within a given eating pattern, such as during study sessions, athletic training, or long gaming marathons where every boost counts.

The conversation about caffeine is inseparable from Sugar content and overall dietary context. Original Mountain Dew carries a substantial sugar load, a factor many listeners weigh against the stimulant effect. In contrast, Mountain Dew Zero Sugar preserves the caffeine payload while removing regular sugar from the equation. That means someone can enjoy the same caffeine jolt without adding sugar grams, a consideration that becomes central when discussing daily limits and the long arc of dietary choices. The caffeine signal does not vanish in Zero Sugar; rather, it remains an energetic anchor that can serve as a substitute in a sugar-conscious routine. This juxtaposition of caffeine stability with sugar variability helps explain why the brand has managed to appeal to different consumer segments: those who crave a high-energy pop with sugar, and those who prefer a zero-calorie alternative without sacrificing the familiar punch.

Data quality and source transparency shape how readers interpret these numbers. The figures referenced here draw from detailed product analyses and from official disclosures that list caffeine content by serving size. For readers who want to verify the baseline numbers directly, official product pages provide consistent references to caffeine levels across the major Mountain Dew variants. An internal resource that helps illuminate the precise caffeine content by variant is included in the body of research materials as a targeted reference. It is worth noting that while the 54 mg figure is widely cited for the core flavors, exact numbers can show minor variation due to batch differences or labeling conventions across markets. Yet the overarching pattern remains: Mountain Dew occupies a high rung in the caffeine ladder among mainstream sodas, a status reinforced by the uniformity of caffeine across its principal flavors and the sugar-free option.

From a health and wellness lens, the stability of Mountain Dew’s caffeine content offers a predictable parameter for those who monitor caffeine intake for sleep quality, anxiety management, or other medical considerations. It is not merely about energy in the short term; it’s about how that energy integrates with daily responsibility, exercise, and the need to balance stimulation with rest. People who rely on caffeine for focus may find Mountain Dew a dependable choice within a broader caffeine strategy. Others might use it more situationally, saving it for moments when a quick, reliable alertness boost is most valuable. The scholarly and practical takeaways align: if you value a strong caffeine kick in a carbonated format, Mountain Dew delivers, consistently, across its line, with a sugar-free option that keeps the stimulant levels intact.

For readers who want to explore this topic further, a concise breakdown of caffeine content across a spectrum of beverages—including Mountain Dew and its peers—offers a helpful comparative frame. The analysis here intentionally centers on mainstream sodas because they are commonly available, widely consumed, and price-accessible, which makes the caffeine dynamics relevant to a broad audience. The core message remains simple: Mountain Dew’s caffeine level is high relative to many other soft drinks, and that high baseline carries implications for daily planning, flavor choice, and overall consumption strategy. As taste and energy demand continue to collide in consumer choices, the drink’s profile endures as a reference point for what many people expect when they pick up a can during a long day of study or a late-night gaming session.

To connect readers with a tangible resource that supports these figures, the discussion aligns with an internal reference point that specifically addresses Mountain Dew caffeine content. For a focused dive into the exact caffeine numbers and how they map to each major variant, the detailed source provides a precise, variant-by-variant accounting. This internal link serves as a bridge to the broader dataset, helping readers corroborate the numbers while retaining the narrative emphasis on how Mountain Dew positions itself within the caffeine landscape. c

In the larger arc of beverage science and consumer behavior, Mountain Dew’s caffeine stance is more than a statistic. It is a marker of brand identity and a practical tool for daily caffeine budgeting. It speaks to the rhythm of modern life—short bursts of energy, frequent reminders to stay alert, and the ongoing negotiation between taste, health, and performance. The data do not exist in a vacuum. They ride alongside consumer experiences, the practical realities of energy management, and the evolving conversation about how much caffeine is appropriate for a given moment. For those who crave the crisp snap of a high-caffeine soda after a long morning, Mountain Dew remains a go-to choice, a reliable signal in a crowded beverage aisle.

Internal resource: caffeine content MT Dew, a targeted reference that consolidates the numeric profile across flavors. caffeine-content-mt-dew

External resource: For an authoritative overview of Mountain Dew’s brand and nutritional information as published by the parent company, consult the official product information page. External resource: https://www.pepsico.com/en/our-brands/mountain-dew

Caffeine at the Edge of Focus: High-Caffeine Citrus Sodas and the Energy-Health Balance

Across the landscape of everyday beverages, a citrus-forward, highly caffeinated soda sits at a distinctive crossroads between quick energy and sustained well-being. This chapter traces that line not by shouting about brands or flavor profiles, but by examining the caffeine level itself—the measured spark that people often chase when they reach for a cold can before a study session, a gaming marathon, or an outdoor excursion. The core fact remains simple and powerful: a typical 12-ounce can of this beverage carries roughly 54 to 55 milligrams of caffeine. That figure places it at the high end of mainstream soft drinks, higher than many traditional colas and notably higher than a number of other common caffeinated beverages, which makes it a frequent choice for those seeking a rapid edge in attention and alertness. The caffeine content, paired with a relatively pronounced sugar load, defines both its appeal and its risk profile in daily life.

To understand why caffeine matters here, it helps to see the cognitive rituals people develop around caffeine: the expectation of sharper focus, steadier vigilance, and quicker reaction times, especially during tasks that demand sustained attention. In practice, many gamers, students, and outdoor enthusiasts report that this beverage helps them push through long sessions. The stimulant effect of caffeine is well-documented in scientific literature; moderate intake can sharpen attention, enhance vigilance, and improve response speed. When that boost is paired with a familiar flavor and a familiar snack routine, it becomes a dependable cue to power through fatigue. In the culture surrounding long sessions—whether in front of a screen or in the field—the drink becomes more than a simple source of caffeine. It becomes a ritual, a bridge between fatigue and performance, a small but meaningful contributor to endurance during demanding moments.

But there is a careful balance to strike. The same high caffeine level that supports short-term alertness also sits alongside a substantial sugar load in the regular version of the beverage. In many markets, a standard can carries around 46 grams of sugar. That amount of sugar can drive a rapid energy spike, followed by a noticeable drop that may feel like a rebound fatigue if the overall daily intake is not balanced. The biology behind this pattern is straightforward: sugar rapidly stimulates blood glucose, delivering quick energy to the brain and muscles; caffeine, meanwhile, modulates neural activity and arousal. Together, they can create a temporary uplift that feels driving and dependable—until hours later when sleep or mood signals a downshift. For individuals who already contend with jitteriness or heightened heart rate from caffeine, or for those whose daily routines keep a close watch on sleep cycles, the combined effect can be more unsettling than energizing.

From a health standpoint, the conversation around this beverage must also consider how caffeine and sugar interact with longer-term physiology. In isolation, caffeine can be tolerated well by many adults when consumed in moderate amounts, but the daily total matters. The recommended general ceiling for caffeine for most adults sits around 400 milligrams per day. When a single can contributes roughly 54 milligrams, several daily servings can push intake toward that ceiling or beyond, particularly for people who enjoy multiple caffeinated beverages across different products. The additive effect raises questions about sleep quality, anxiety, and cardiovascular symptoms such as palpitations or elevated heart rate, especially when consumed later in the day. Sleep disturbance, a common consequence of late-day caffeine intake, can undermine the very energy that caffeine was meant to support. In this light, the beverage’s caffeine content is not merely a marketing figure; it is a key variable in daily energy balance, sleep patterns, and mood regulation.

The health considerations extend beyond sleep and immediate feelings of wakefulness. A broader view of frequent consumption raises concerns about how caffeine and high sugar intake interact with metabolic processes over time. Chronic exposure to high-sugar beverages has been linked, in observational and experimental contexts, with shifts in insulin sensitivity and triglyceride handling. While a single can per day is unlikely to derail metabolic health for most people, habitual patterns—especially when paired with other high-sugar foods and beverages—can compound risk. The kidneys, too, come into view in discussions of high-sugar, high-caffeine beverages. Some research suggests that sustained exposure to these drinks can influence renal vascular dynamics, potentially affecting renal blood flow and kidney function over the long term. These are not inevitable outcomes, but they underscore an important point: energy and alertness come with a price tag that accumulates when caffeine and sugar are treated as a daily staple rather than as occasional tools.

Concretely, the practical path for consumers becomes an exercise in mindful timing and portion control. For most adults, staying within the 400-milligram daily threshold requires a simple accounting: if you drink a can, you reduce the number of additional caffeinated servings you choose for the rest of the day. This arithmetic is not merely about avoiding a \”jolt\” later. It also protects sleep quality, which in turn preserves daytime energy more reliably than caffeine alone can. In this light, the high caffeine level of the beverage can be framed as a useful tool when used sparingly and strategically, rather than as a default energy source. Those who want the same alertness without the sugar burden have a practical option: a zero-sugar or low-sugar variant of the beverage. It preserves the familiar caffeine dose while offering a different metabolic footprint. The choice is not simply about flavor or taste; it is about shaping a personal energy profile that aligns with sleep, mood, and long-term health goals.

For readers who want to dig deeper into the caffeine profile of this kind of beverage, a concise overview can be found in a dedicated explainer that looks specifically at how much caffeine is in a serving of this drink. how-much-caffeine-in-a-mountain-dew. The link provides a practical benchmark for comparing caffeine across beverages without wading through marketing claims or anecdote. It is a useful tool for anyone who wants to balance the desire for quick energy with a clear-eyed sense of daily caffeine budgeting. Of course, any comparison would be incomplete without acknowledging the broader context. This beverage sits in a spectrum that includes coffee, tea, energy drinks, and other sodas, each with its own caffeine footprint and sugar profile. By looking at these footprints side by side, a reader can map out a daily energy plan that guards sleep, mood, and metabolic health while preserving the ability to stay alert when necessary.

Within that broader frame, there’s no single answer about how often one should reach for a can of this high-caffeine soda. Personal tolerance, sensitivity to caffeine, sleep patterns, and overall dietary goals will steer the decision. A practical approach is to treat every can as a discrete dose: one dose per day or fewer, especially if you are combining this beverage with other caffeine sources. If your schedule demands heightened concentration for several hours, a more balanced strategy might involve spreading caffeine across earlier parts of the day, with a preference for beverages that carry less sugar or no sugar at all for later hours. In this sense, the caffeine level becomes a tool that can be tuned to fit the rhythm of an individual life, rather than a constant refrain in the daily routine.

The chapter’s synthesis emphasizes one central takeaway: the caffeine level in this citrus-forward beverage is a major driver of both its appeal and its risk. The energy boost it promises—quick, reliable, and culturally familiar—must be weighed against the sugar burden and the potential habit-forming pull that can accompany repeated use. This is not a warning against enjoyment; it is an invitation to informed choice. It asks readers to consider their own energy needs, sleep health, and metabolic balance as they decide how to incorporate or limit this beverage in their daily routines. In doing so, the reader can preserve the sense of urgency and focus that caffeine provides while minimizing the price paid in rest, mood, and long-term health.

External reference and context can complement this discussion. For readers seeking a broader comparison with other caffeinated beverages, a reputable external resource offers detailed caffeine content for several popular drinks, including the specific example discussed here. https://www.healthline.com/nutrition/dr-pepper-caffeine-content

Power in the Citrus Pulse: How Mountain Dew’s Caffeine Level Shapes Consumer Trends

Mountain Dew sits at a curious crossroads in the beverage world, where citrus brightness and an energizing jolt converge. The mid-50s milligrams of caffeine in a standard 12-ounce can are not merely a numeric detail; they signal a deliberate chemistry between taste and performance. For many fans, the caffeine level is a shorthand for readiness, a quick prompt to focus or sustain concentration during a late-night study session or a marathon gaming bout. In this space, caffeine is not a mere additive; it is a defining attribute that actively shapes how people perceive value, urgency, and satisfaction. The flavor is bold enough to demand attention, yet the energy kick provides a practical payoff that makes the drink feel more like a tool than a treat. This pairing—bold flavor with dependable energy—has anchored Mountain Dew in a durable niche where function and refreshment reinforce each other, and the result is a consumer relationship built on reliability as much as on taste.

From the consumer point of view, caffeine is rarely a standalone consideration. It operates as a cue that blends performance expectations with sensory delight. The fact that a single can delivers a noticeable lift means the beverage positions itself as a companion for study, creative work, and social gaming sessions. That positioning resonates particularly with younger adults and students who view an energy boost as a practical aid rather than a mere indulgence. In turn, the citrus profile—bright, tangy, and instantly recognizable—acts in concert with caffeine to create a distinctive experience. The drink is not just about quenching thirst; it offers a quick, memorable sequence: bite of citrus, rush of caffeine, and a sense of momentum that keeps the user engaged with the moment. Across countless conversations, this pairing emerges as a core reason for repeat purchase and brand advocacy among peers and streaming communities alike.

The market response to this energy-forward identity has, in recent years, increasingly prioritized transparency and consistency. Consumers want to know what they’re getting, especially when the product promises a tangible effect. The rebalance toward clearer labeling and straightforward messaging reflects a broader shift in beverage culture toward accountability and trust. In practice, this means firms emphasize not just taste but also the functional benefits that come with caffeine. When a drink proclaims readiness as part of its brand promise, the information must be accessible, easy to compare with alternatives, and congruent with actual experience. Such transparency is not merely about compliance; it is a strategic asset that cultivates credibility and loyalty among a discerning audience that values both flavor and function. The Australia re-launch of Mountain Dew Energised, for instance, underscores how an explicit emphasis on added caffeine can reinforce a consistent energizing identity across markets. The move signals a deliberate effort to align with international expectations while preserving a familiar taste profile, acknowledging a global audience that views caffeine content as part of a drink’s personality and reliability. These shifts illustrate a broader trend: consumers increasingly demand that stimulant content be communicated clearly and that the energy benefits align with the sensory experience.

Flavor innovation in this context does not occur in a vacuum. It is guided by how caffeine perception interacts with mouthfeel, finish, and overall satisfaction. Variants such as Voltage and Baja Blast have demonstrated that high caffeine levels can coexist with adventurous flavor explorations. In internal discussions across product development teams, social media sentiment about energy impact, focus group feedback, and regional sales data shapes decisions about both new flavors and the positioning of existing ones. The upshot is a coherent narrative where energy remains central, serving as a constant that grounds experimentation. Consumers who encounter a new variant still carry with them an expectation of a certain energy profile, and that expectation helps convert curiosity into regular use. The caffeine baseline thus serves as an anchor—firm enough to reassure daily users, flexible enough to accommodate flavor innovation, and transparent enough to invite ongoing dialogue about what the drink does for them.

For those seeking lower-sugar or zero-calorie options, the brand has endeavored to preserve energy delivery without sacrificing the tang or brand familiarity. Diet Mountain Dew, with its signature citrus punch, retains the same broad caffeine footprint while offering a reduced calorie option. This strategy acknowledges a crucial consumer segment that worries about sugar intake but does not want to compromise on the energy lift that defines the beverage’s appeal. The presence of multiple formats under a single energy umbrella—regular, diet, and zero-sugar—signals a deliberate effort to provide choice without eroding the core promise: caffeine as a central feature. That approach expands the product’s reach to students balancing budgets and health concerns, to professionals who need a steady daytime lift, and to gamers who rely on a predictable caffeine cadence as a part of their routine. It is a practical articulation of a broader market truth: consumers want flexibility and consistency in equal measure, and caffeine is the common thread tying flavor, energy, and personal pace together.

The psychology of caffeine in this context extends beyond mere physiological effects. Higher caffeine levels in a familiar citrus framework influence expectations about intensity, aftertaste, and even pacing of consumption. A strong energy cue can shape how customers pace themselves, how they perceive the drink’s sweetness relative to its lift, and how they discuss the product with friends and peers. For many, a reliable energy boost comes with a associated routine—a set of rituals that includes a chilled can, a quick sip during a break, and a moment of mental reset before resuming a task. In this light, caffeine becomes not only a chemical driver but also a social cue, a signal that one is ready to engage with the next moment. The interplay between taste and energy helps explain why this product maintains a resilient presence in a landscape crowded with healthier options, exotic flavors, and shorter-lived trends. The expectation of energy, once established, fosters loyalty that outlasts fashion and seasonality.

From a broader marketing vantage point, the narrative around caffeine levels emphasizes reliability and accessibility. Companies benefit when they can promise a familiar energy lift across formats—cans, bottles, and limited-run flavors—without introducing excessive variability in caffeine delivery. This consistency supports a sense of dependable value that can translate into repeat purchases and daily routine integration. The ability to depend on a consistent jolt makes the beverage more than a fleeting flavor choice; it becomes a predictable part of daily life for many consumers. In a marketplace sensitive to health trends and competing energy drinks, that reliability is a meaningful differentiator. It reassures consumers who want stimulation without needing to chase after every new product, and it invites ongoing exploration within a trusted framework.

To ground this discussion in concrete numbers without derailing the conversation, the standard formulation in a 12-ounce can commonly hovers around the mid-50 milligrams range of caffeine. Exact figures vary slightly by variant and batch, but the core proposition remains clear: a strong, recognizable energy lift accompanies a bold, citrus-forward taste. This combination explains why the product endures as a familiar choice for those who value both flavor and focus. The consumer’s decision calculus often weighs taste satisfaction against energy payoff, and in this case, the scale tips toward a balanced package that provides audible cues—a pop of citrus, a noticeable jump in alertness, and a confidence that the product will perform as expected when needed most. The result is a durable consumer relationship built not on novelty alone but on a reliable, well-understood energy profile married to a memorable taste experience.

For readers who wish to explore the precise caffeine content across variants, a concise resource covers those figures and can serve as a quick reference: the caffeine content MT Dew. This kind of cross-check supports informed comparisons when people weigh flavor choices against energy expectations. And for those who want to verify the official stance on caffeine directly from the source, an external reference provides the authoritative data on stimulant content. See Mountain Dew’s caffeine information here: Mountain Dew caffeine information.

Tracing the Steady Jolt: A History of Caffeine in a Citrus Soda

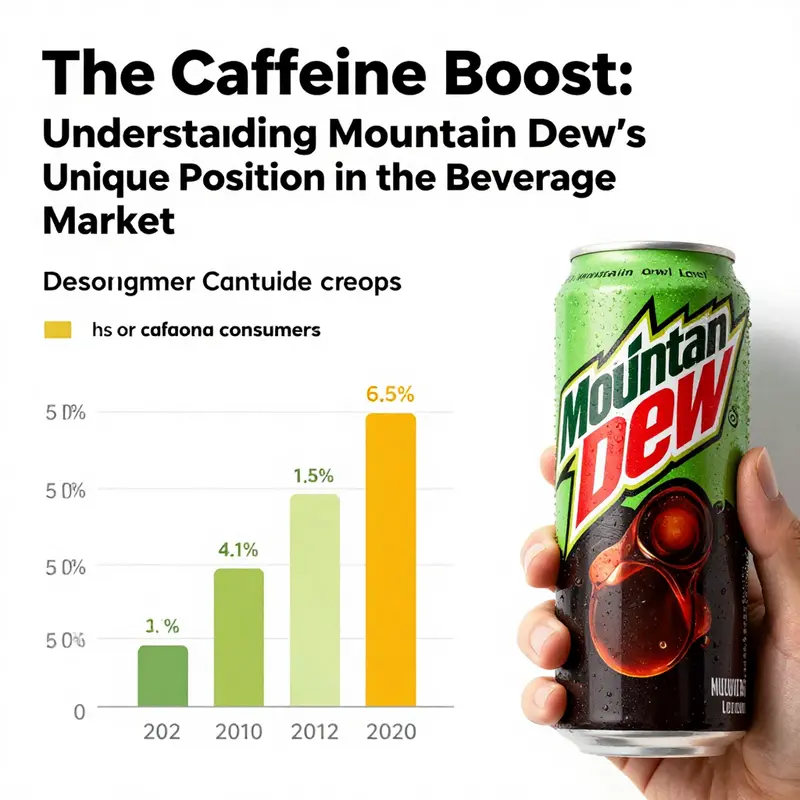

Across decades, this citrus-forward beverage has carried a recognizable energy cue that fans quietly expect. The chapter traces how caffeine has become a steady, guiding pulse rather than a loud proclamation. Early on, the drink delivered roughly 54 mg of caffeine per 12-ounce can, placing it above many traditional sodas while staying approachable for a broad audience. This level provided a reliable baseline for narratives centered on outdoors, study, and momentum, without overshadowing flavor or everyday enjoyment.

As the market evolved, the brand preserved the core formula while exploring packaging, flavors, and formats. Limited editions occasionally nudged the caffeine content higher toward the mid 60s or into the 70 mg range, signaling a willingness to test the upper bounds of energy within a controlled and responsible context. The mainline product remained anchored around the mid 50s to preserve continuity for long-time fans even as new varieties emerged.

The balance of consistency at the core and experimentation at the edges became a defining feature of the beverage’s identity. Consumers could trust that a crisp lift would arrive with the same dependable bite, while the portfolio could broaden to zero sugar versions, larger formats, or flavor-forward riffs. The caffeine narrative then serves as both data point and storytelling device: a tangible cue that anchors marketing messages and shapes expectations without overpowering taste or accessibility.

Today, as regulators and health discussions emphasize transparency, the brand communicates caffeine in a straightforward way. The baseline remains a robust, approachable lift that supports focus and momentum in daily life, while limited editions offer stronger jolts for moments that demand extra energy. In the wider beverage landscape, this arc shows how a single metric per can can travel through time as a reliable reference point for energy culture and brand posture.

Final thoughts

Navigating Mountain Dew’s caffeine levels offers crucial insights for business owners aiming to meet consumer needs and enhance their product offerings. Recognizing the significance of caffeine content not only aids in understanding consumer preferences but also encourages responsible consumption within health frameworks. By leveraging the evolving trends in caffeine consumption, business operators can better position their portfolios and connect with health-conscious consumers effectively. As the demand for various caffeinated beverages continues to rise, mastering the specifics of each product’s caffeine level becomes essential for long-term success.